Offshore Trustee Solutions for International Riches Management

Wiki Article

Sailing Into Success: Opening the Potential of Offshore Count On Services for International Wide Range Preservation

The Advantages of Offshore Trust Services for Riches Preservation

You'll be impressed at the benefits of offshore trust fund services for wide range preservation. By placing your properties in an overseas trust fund, you produce a legal obstacle that makes it tough for others to access your wide range.An additional advantage of offshore trust solutions is the capacity for tax optimization. Many overseas jurisdictions use beneficial tax obligation regulations and incentives that can aid you minimize your tax obligation obligation. By making use of these services, you can lawfully lower your tax worry and optimize your wide range build-up.

Moreover, overseas count on solutions give a higher degree of personal privacy and confidentiality. Unlike in onshore territories, where economic information may be quickly available, overseas depends on supply a greater level of privacy. This can be particularly appealing if you value your privacy and desire to maintain your monetary events very discreet.

Furthermore, offshore depend on solutions offer adaptability and control over your possessions. You can select the conditions of the trust fund, define how it must be handled, and also determine when and just how your beneficiaries can access the funds. This level of control allows you to tailor the depend your specific demands and objectives.

Recognizing the Lawful Framework of Offshore Counts On

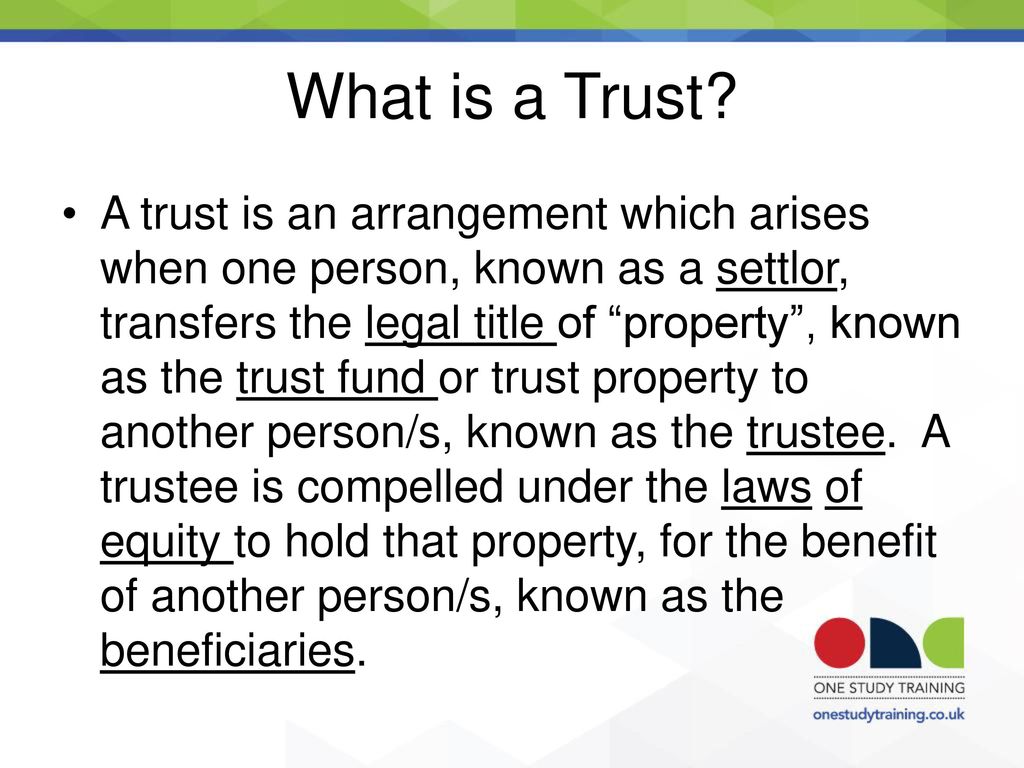

Comprehending the legal framework of overseas trust funds can be intricate, yet it's necessary for individuals seeking to preserve their wide range - offshore trustee. When it pertains to offshore depends on, it is very important to recognize that they are regulated by specific legislations and laws, which vary from jurisdiction to jurisdiction. These lawful frameworks establish exactly how the depends on are developed, handled, and exhaustedOne secret aspect to consider is the selection of the jurisdiction for your offshore trust. Each territory has its very own collection of policies and laws, and some might supply extra desirable conditions for wealth conservation. You'll require to analyze factors such as the security of the lawful system, the degree of privacy provided, and the tax obligation effects prior to making a decision.

As soon as you have actually picked a territory, it's essential to recognize the legal requirements for setting up and keeping an offshore trust. This consists of adhering to reporting responsibilities, guaranteeing correct paperwork, and adhering to any constraints or limitations enforced by the jurisdiction. Failing to meet these requirements can cause legal and financial effects.

:max_bytes(150000):strip_icc()/housing-trust-fund-5207067_Final-43a9f6a0e1b146c996c339d6c16e1429.png)

Secret Considerations for Choosing an Offshore Trust Fund Jurisdiction

When determining on an overseas trust fund jurisdiction, it's crucial to meticulously consider factors such as the jurisdiction's legal security, degree of confidentiality, and tax obligation effects. Deciding for a jurisdiction with positive tax laws can assist take full advantage of the benefits of your offshore trust. By very carefully taking into consideration these variables, you can pick an overseas depend on jurisdiction that fits your requirements and supplies the required degree of defense for your wide range.Taking Full Advantage Of Asset Protection Through Offshore Trust Frameworks

Optimizing possession protection can be achieved via offshore trust structures that offer a protected and confidential environment for preserving your wide range. By using offshore trust funds, you can safeguard your properties against possible legal claims and guarantee their long-lasting conservation.Offshore trust frameworks supply a variety of advantages that can help shield your possessions. One key benefit is the capability to develop trust funds in jurisdictions with solid legal frameworks and durable property security regulations. These jurisdictions are commonly popular for their dedication to confidentiality, making it difficult for financial institutions or litigants to gain access to info about your trust fund or its assets.

Moreover, offshore trust funds offer a layer of privacy. By placing your possessions in a trust, you can keep a certain level of privacy, securing them from unwanted focus or scrutiny. This can be especially useful for high-net-worth individuals or those in delicate careers.

Along with asset protection, overseas trust fund frameworks use tax benefits. Some jurisdictions impose little to no tax on revenue produced within the count on, allowing your wealth to worsen and expand in time. This can lead to substantial tax cost savings and boosted riches conservation.

Overall, overseas count on frameworks provide a protected and confidential atmosphere for protecting your wide range. By making best use of possession protection through these structures, you can make certain the long-lasting preservation and development of your possessions, while appreciating the benefits of personal privacy and tax benefits.

Exploring Tax Benefits and Compliance Demands of Offshore Counts On

Exploring the tax obligation advantages and conformity demands of offshore depends on can offer beneficial insights into the monetary advantages and legal commitments linked with these frameworks. Offshore trusts are often located in jurisdictions that offer beneficial tax programs, such as reduced or absolutely no taxes on count go on earnings and capital gains. By positioning your properties in an offshore trust, you can legitimately minimize your tax obligation responsibility and optimize your wealth conservation.visit this web-site

Verdict

So there you have it - the possibility of offshore trust solutions for international wide range conservation is immense. By comprehending the benefits, legal structure, and vital factors to consider, you can make educated decisions to optimize possession defense. Additionally, discovering the tax obligation advantages and compliance needs of offshore depends on can better enhance your riches preservation approaches. Do not lose out on the chances that offshore count on services can provide - cruise into prosperity today!When determining on an overseas depend on jurisdiction, it's important to very carefully take into consideration aspects such as the jurisdiction's legal security, degree of privacy, and tax ramifications. By very carefully taking into consideration these aspects, you can select an overseas trust territory that fits your needs and gives the essential degree of security for your riches.

Offshore trusts are frequently learn the facts here now situated in territories that provide beneficial tax obligation routines, such as reduced or no taxation on trust fund earnings and resources gains - offshore trustee. By positioning your properties in an offshore trust, you can lawfully reduce your tax obligation liability and optimize your wealth conservation. Additionally, discovering the tax obligation advantages and conformity demands of overseas depends on can additionally enhance your wide range preservation methods

Report this wiki page